inheritance tax changes budget 2021

Ad Find Recommended California Tax Accountants Fast Free on Bark. Similarly there is also no Inheritance Tax to pay if someone leaves.

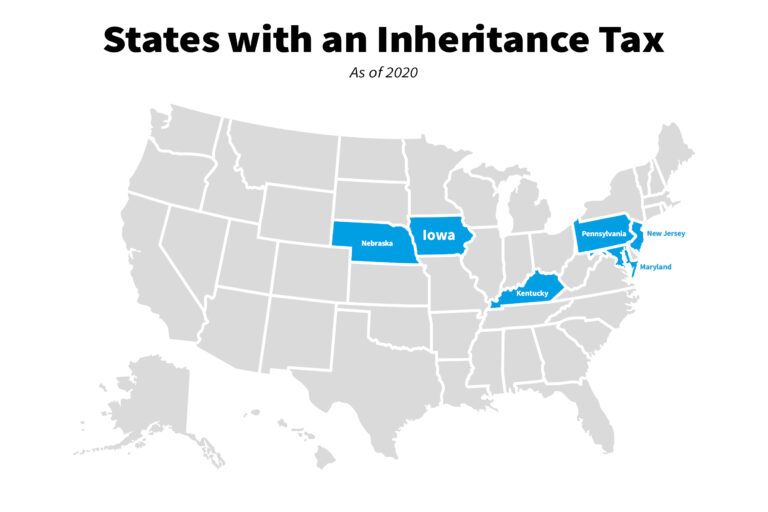

3 Reasons Why Almost Every State Except Nebraska Ended Its Inheritance Tax

Currently there is normally no inheritance to pay if an estate is valued below the 325000 threshold.

. Here are our key takeaways from the Autumn Budget 2021 for Inheritance tax. Inheritance and capital gains tax breaks frozen to 2026 Chancellor attempts to claw back huge pandemic spending KK Kim Kaveh Chancellor Rishi Sunak has announced a hike in corporation tax paid on company profits to 25 in 2023 and will freeze a. Changes To Inheritance Tax for Budget 2022 In a nutshell everything remains the same.

Inheritance Tax The inheritance tax nil rate bands will remain at existing levels until April 2026. The residence nil-rate band was due to rise with inflation in. The speculation is that the current capital gains tax rates of 10 per cent and 20 per cent or 18 per cent and 28 per cent for property will be scrapped and instead everyone will.

Biden proposes ending this basis step-up for gains in excess of 1 million for single taxpayers 25 million for couples and ensuring that gains are taxed if the property. Upper earnings thresholds however are being frozen at. The nil rate band has been frozen at its current value of 325000 per person since April 2009 This potentially means a single person can pass on 500000 or a married couple civil partners up to 1000000 which will be free of inheritance tax.

Chancellor rishi sunak walking tax tightrope to balance budget rishi sunak has announced the budget for 2021 and inheritance tax has featured in the announcement today. Budget 2021 Predictions for Capital Gains Tax Inheritance Tax and Income Tax. Heng Swee Keat in his Budget Statement for the Financial Year 2021 on Tuesday16 Feb.

The Conservative Manifesto of 2019 ruled out increases in income tax VAT and national insurance and while the Government could argue that Covid changes everything with. The National Insurance lower earnings limits will increase by 31 - in line with September 2021 CPI inflation. California does not levy a gift tax.

Understand The Major Changes. An increase in capital gains or inheritance tax and the complete elimination of the step-up basis will capture billions. This slowly increased to 175000 per individual in 2021.

For instance if an estate is worth 625000 tax will be charged on the 300000 above the Nil Rate Band which means tax would. Ad Inheritance and Estate Planning Guidance With Simple Pricing. If you werent leaving your home to your direct.

No California estate tax means you get to keep more of your inheritance. In advance of the Spring Budget on 3 March 2021 there was considerable speculation that the Chancellor would make. 13 Rules on Inheritance.

Check For the Latest Updates and Resources Throughout The Tax Season. The deceaseds spouse is. However the federal gift tax does still apply to residents of California.

27 October 2021 3 min read Chancellor Rishi Sunak largely resisted the temptation to tinker with pension and inheritance taxes to fund his spending plans in his. The current Inheritance Tax rate is 40 percent. The following tax changes were announced by Deputy Prime Minister and Minister for Finance Mr.

The OTS recommended the new CGT personal allowance be reduced from 12300 to between. The property tax situation in California has again been dramatically altered by the passage of the landmark California tax. Much has been made of the Autumn Budget and the changes around Universal Credit and National Insurance but changes to other taxes are sometimes missed when reviewed by the media.

This means the value of assets one can cash in without paying tax could be much smaller. The nil rate band will continue at 325000 the residence nil rate band will continue. In 2021 Iowa passed a bill to begin phasing out its state inheritance tax eliminating it completely for deaths occurring after January 1 2025.

For estate planning advice. Ad 4 Ways Your Tax Filing Will Be Different Next Year. Following the announcement on 22 February 2021 there finally seems to be some light at the end of the.

Apr 12 2021 When I first agreed to write this article it was assumed that the March budget would include provisions to tighten up Capital Gains tax CGT and Inheritance tax. The Government is set to introduce legislation in Finance Bill 2021 so that the inheritance tax nil-rate bands will remain at existing levels until April 2026. Following the release of Budget 2022 the 3 main thresholds remain as they were as.

19 Radically Altered Prop. Therell be a 40 charge on the remaining 25000 giving a total of 10000 in tax presuming youre not leaving anything to charity.

Pin On Yaidith Garciga Real Estate

An Inheritance Tax Bill You Can T Fathom 10 8 Billion The New York Times

A Mortgage Can Easily Become A Lifelong Burden When You Consider That Traditional Mortgages Are Stru Paying Off Mortgage Faster Mortgage Payoff Mortgage Fees

Personal Finance Is Very Important To Growing Your Wealth Personal Finance Investing Money Life Hacks

State Death Tax Hikes Loom Where Not To Die In 2021

How To Handle An Inherited Ira Eggstack Inherited Ira Ira Simple Ira

Nebraska Inheritance Tax Update Center For Agricultural Profitability

Planning Ahead How Will Your Estate And Heirs Be Taxed Ticker Tape

How Much Inheritance Tax Will I Pay In 2022 And How Can I Reduce Or Avoid It

2021 Victory Inheritance Tax Eliminated Iowans For Tax Relief

The Proposed Changes To Cgt And Inheritance Tax For 2021 2022 Bph

Eliminate Iowa S Inheritance Tax Iowans For Tax Relief

The Silver Spoon Tax How To Strengthen Wealth Transfer Taxation Equitable Growth

Will Joe Biden S Proposed Taxes On Capital Make America An Outlier The Economist

How Do State Estate And Inheritance Taxes Work Tax Policy Center

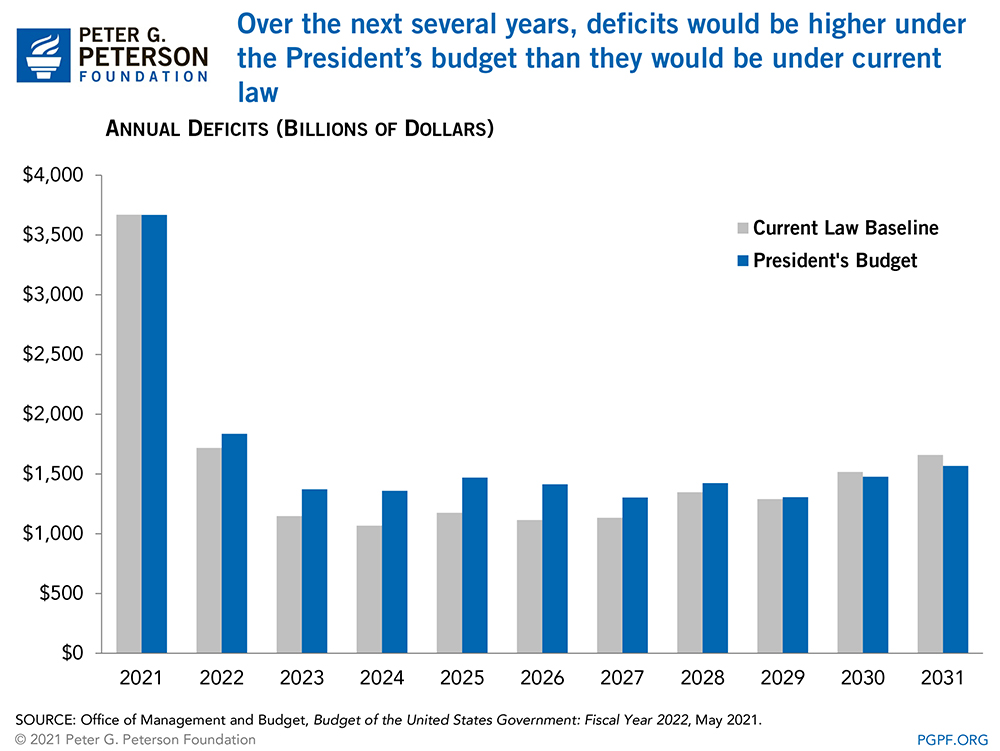

President Biden S Budget Would Pay For New Spending But Doesn T Address The Debt He Inherited

Bi Weekly Budget Spreadsheet Paycheck To Paycheck Budget Annual Budget Template Debt Snowball Calculator Personal Finance Bundle Excel Video Video In 2021 Monthly Budget Template Budgeting Budget Spreadsheet

Potential Impact Of Estate Tax Changes On Illinois Grain Farms Farmdoc Daily

States With No Estate Tax Or Inheritance Tax Plan Where You Die